Debt Consolidation in Tucson AZ

Escape the Debt Trap: Consolidate and Reclaim Your Financial Peace!

Take the first step towards financial freedom →

Tucson Debt Consolidation

Managing multiple debts can be overwhelming, especially when juggling various interest rates, payment schedules, and creditors. Debt consolidation is an effective solution for many, simplifying finances by merging multiple debts into one manageable payment. As the leading debt consolidation consultant in the area, we offer expert guidance and tailored solutions to help you regain financial stability and peace of mind.

What We Offer

Our services are tailored to fit your unique financial situation with a focus on long-term financial independence. We begin by conducting a comprehensive assessment of your current financial landscape, including your debts, income, and overall financial health. From there, we craft a personalized strategy that aligns with your goals for building lasting wealth, rather than just managing debt.

Instead of simply offering debt consolidation, we empower you with proven financial education and strategies to help you not only reduce your liabilities but also take control of your financial future. This includes teaching you how to lower interest rates, restructure payments, and build a plan that sets you on the path to financial freedom. Additionally, we provide ongoing guidance to ensure that you’re equipped to avoid common financial pitfalls and continue to grow your wealth.

Our ultimate goal isn’t just to consolidate your debt but to equip you with the skills and tools necessary to create financial freedom for life.

Where We Serve

We recognize that financial challenges are universal, and our mission is to provide support wherever you are. Whether you're in Oro Valley, Marana, or any other location, our expert consultants are here to help. We offer virtual consultations, ensuring that you have access to life-changing financial strategies no matter where you’re located. Distance is never a barrier when it comes to empowering you with the knowledge and tools to achieve financial freedom.

Debt Consolidation Near Me

When searching for "debt consolidation near me," it’s important to find more than just options—you need a trusted advisor with a proven track record. Our reputation is built on helping individuals achieve financial freedom through education and actionable strategies. We take a personalized approach, getting to know your specific financial situation and goals so we can create a custom plan that goes beyond just managing debt.

Our team stays ahead of the curve, always updated on the latest financial strategies, ensuring you receive the highest level of guidance. Whether you're dealing with credit card debt, medical bills, or other financial burdens, we provide the tools and education you need to take control of your financial future and build lasting wealth.

Why Should You Go WIth Us?

In today’s financial world, managing multiple debts can feel like a constant struggle. With high interest rates, different due dates, and the stress of juggling multiple payments, it’s easy to feel overwhelmed. We not only understand these challenges but provide a smarter, more effective solution. Our approach is designed to help you streamline your finances, consolidate your debts into a clear, manageable plan, and most importantly, equip you with the knowledge to achieve lasting financial freedom. Here’s why partnering with us is a game-changer on your path to financial independence.

Personalized Debt Solutions

We recognize that each client's financial situation is unique. We take the time to understand your specific needs and create a customized debt consolidation plan tailored to your circumstances. Whether you have credit card debt, medical bills, or personal loans, our personalized approach ensures that you get the best possible outcome.

Professional Financial Guidance

Our team of financial experts is here to guide you every step of the way. From the initial consultation to the final payment, we provide ongoing support and advice to help you stay on track. We also offer valuable resources and tools to help you improve your financial literacy and make informed decisions about your money.

Lower Interest Rates

One of the most significant benefits of debt consolidation is the potential to secure a lower interest rate. By consolidating your debts with us, you can reduce the amount of interest you pay over time. This not only lowers your monthly payments but also helps you pay off your debt faster. Our team works diligently to negotiate the best rates on your behalf.

Improved Credit Score

Debt consolidation can have a positive impact on your credit score. By reducing your overall debt and making consistent, on-time payments, you can gradually improve your credit rating. A better credit score opens up more financial opportunities in the future, such as lower interest rates on loans and better credit card offers.

Simplified Payments

Managing multiple debt payments can be confusing and stressful. With us, you only have to worry about one monthly payment. This simplified payment process makes it easier to stay on top of your finances and avoid missed payments, which can negatively impact your credit score.

Stress Relief

Financial stress can take a toll on your mental and physical health. By consolidating your debts with us, you can alleviate some of this stress. Knowing that you have a clear plan and the support of our experienced team can provide peace of mind and allow you to focus on other important aspects of your life.

If you're ready to take control of your finances and start your journey toward debt freedom, we are here to help. Our friendly and knowledgeable team is ready to answer your questions and guide you through the debt consolidation process. Contact us today to schedule a consultation and discover how we can help you achieve financial stability and peace of mind. Don't let debt control your life!

Discover Who We Are

We specialize in helping individuals regain control of their finances. Our dedicated team offers tailored solutions to simplify and manage your debt. By consolidating multiple debts into a single, manageable payment, we aim to reduce financial stress and improve your overall financial health. Our approach involves understanding your unique situation, offering expert advice, and creating a personalized plan that fits your needs. With a focus on transparency and support, we guide you through every step of the consolidation process. Our goal is to empower you to achieve financial stability and peace of mind. We’re committed to providing effective and compassionate solutions to help you overcome debt challenges and build a brighter financial future.

The Pros and Cons of Debt Consolidation

Debt consolidation is a financial strategy that many people consider when juggling multiple debts. By combining several debts into a single loan, it aims to simplify repayments and potentially reduce interest rates. However, like any financial decision, it comes with its own set of advantages and disadvantages. Understanding these can help you decide if debt consolidation is the right choice for your situation.

Pros

Cons

If you're considering debt consolidation and want to explore your options, we're here to help. Our team can provide personalized advice based on your financial situation, ensuring you make an informed decision. Contact us today to learn more about how we can assist you in managing your debt effectively.

Home Equity Line of Credit (HELOC)

Unlock the potential of your home with our home equity line of credit (HELOC) services in Tucson, AZ. A HELOC allows you to borrow against the equity you've built in your home, providing you with flexible access to funds whenever you need them. Whether you're planning a home renovation, consolidating debt, or covering unexpected expenses, our options offer competitive rates and terms tailored to your financial situation. With easy access to funds and the freedom to use them as needed, our services are designed to give you the financial flexibility and peace of mind you deserve.

Personal Line of Credit (PLOC)

Our personal line of credit (PLOC) services in Tucson, AZ offer flexible financial solutions tailored to your needs. Whether you're planning a major purchase, handling unexpected expenses, or consolidating debt, our PLOC provides access to funds when you need them most. Unlike traditional loans, a PLOC allows you to borrow and repay funds repeatedly, making it an ideal option for ongoing financial management. Our team is dedicated to helping you navigate the application process, ensuring you understand the terms and benefits of your credit line. With competitive rates and personalized service, we aim to support your financial goals and provide peace of mind. Choose our services for a reliable, accessible, and convenient way to manage your finances.

Business Line of Credit (BLOC)

Whether you're looking to manage cash flow, invest in growth opportunities, or handle unexpected expenses, our business line of credit (BLOC) services in Tucson, AZ provides a convenient and reliable source of funding. Unlike traditional loans, a BLOC allows you to borrow up to a certain limit and only pay interest on the amount you use. This flexibility ensures you have access to funds when you need them most without committing to a fixed repayment schedule. Our team is dedicated to helping businesses navigate the application process and secure the credit that best suits their financial goals. With our services, you can focus on growing your business with confidence and ease.

Debt Management Plans (DMPs)

We offer comprehensive debt management plans (DMPs) services in Tucson, AZ designed to help individuals regain control of their finances. Our services provide tailored solutions to manage and reduce debt effectively. We start by assessing your financial situation and developing a customized plan that consolidates your debts into one manageable monthly payment. Our team works directly with creditors to negotiate better terms and lower interest rates, making it easier for you to pay off your debts. Throughout the process, we offer guidance and support to ensure you stay on track and achieve financial stability. Whether you’re dealing with credit card debt, medical bills, or personal loans, we are here to assist you in reaching your financial goals.

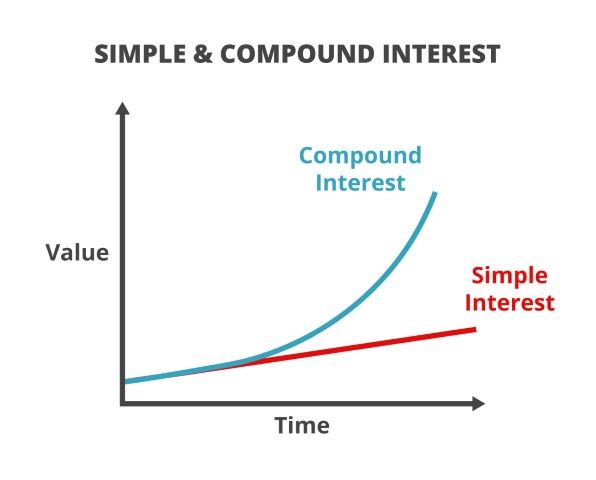

Simple vs. Compound Interest

When it comes to managing your finances, understanding the difference between simple and compound interest is crucial. We offer clear and straightforward explanations to help you grasp these concepts. Simple interest is calculated on the principal amount, while compound interest includes interest on both the principal and any accumulated interest. This means compound interest grows faster over time, potentially yielding higher returns on your investments. Our experts are dedicated to helping you navigate these options, whether you're saving for the future or considering investment opportunities. We provide personalized advice and tools to illustrate how each type of interest works and how they can impact your financial goals. By understanding simple and compound interest in Tucson, AZ, you can make informed decisions and maximize your financial potential.

Total Interest Paid (TIP)

We specialize in total interest paid (TIP) services in Tucson, AZ to help you understand and manage the total interest on your loans. Our expert team provides detailed analyses, showing you how much interest you’ll pay over the life of your loan. This transparency helps you make informed financial decisions, whether you’re buying a home, car, or any other significant investment. By using our services, you gain insights into how different payment strategies and loan terms can affect your overall interest payments. We’re dedicated to helping you minimize costs and maximize savings. Let us guide you through the process to ensure you get the best financial outcome.

Debt Consolidation Loans

We specialize in debt consolidation loans in Tucson, AZ designed to simplify your financial life. Our services help clients merge multiple debts into one manageable loan, reducing the number of payments and often lowering interest rates. This approach can ease the burden of debt, making monthly payments more affordable and predictable. We tailor our debt consolidation solutions to fit individual needs, providing expert advice on how to best manage and repay your debt. Our goal is to offer a clear path to financial stability, helping you regain control over your finances. By choosing our services, you benefit from personalized support and a structured plan to achieve your financial goals. Let us guide you through the debt consolidation process and help you take a significant step toward financial freedom.

401(k) Loans

Whether you're looking to consolidate debt, fund a major purchase, or cover unexpected expenses, our team provides personalized assistance throughout the loan process. We simplify the complexities of 401(k) loans in Tucson, AZ, offering clear guidance on eligibility, repayment terms, and potential impacts on your retirement savings. Our goal is to ensure you make informed decisions that align with your financial goals. With our dedicated support, you can navigate the loan process with confidence, knowing you have a knowledgeable partner by your side. Trust us to help you effectively manage your 401(k) loan needs while keeping your long-term retirement plans in focus.

Debt Settlement Programs

Our debt settlement programs in Tucson, AZ offer a practical solution for those struggling with overwhelming debt. We work with clients to negotiate with creditors, aiming to reduce the total amount owed and create manageable repayment plans. Our team is dedicated to providing personalized support throughout the process, helping you understand your options and making informed decisions. We prioritize clear communication and transparency, ensuring you are fully aware of each step and its implications. By choosing our services, you gain access to a professional team committed to easing your financial burden and helping you achieve a fresh start. Whether you face credit card debt, medical bills, or other financial challenges, our goal is to help you regain control and work towards a debt-free future.

Student Loan Consolidation

If you're managing multiple student loans in Tucson, AZ, we can simplify your financial life. We offer tailored solutions to combine your existing loans into a single, manageable payment. This can lower your monthly payments, extend your repayment term, and potentially reduce your interest rate. Our experienced team works closely with you to assess your financial situation and determine the best consolidation plan. We handle the paperwork and communication with lenders, so you don’t have to. With our help, you can streamline your student loan debt, making it easier to stay on track and achieve your financial goals. Whether you’re looking to reduce stress or save money, our consolidation services are designed to offer relief and simplify your journey to debt freedom.

Our Debt Consolidation Company’s Vision & Mission

In a world where financial challenges are common, our debt consolidation company stands as a beacon of hope. We understand the weight of financial stress and are dedicated to guiding our clients towards a brighter, more secure financial future. Our core values drive us to deliver exceptional service and personalized solutions to help individuals overcome their financial burdens.

Ready to take the first step towards financial freedom? Contact us today to learn more about our debt consolidation services and how we can help you achieve your financial goals. Our team is here to answer your questions and guide you through every step of the process. Don’t let debt hold you back any longer—reach out now and start your journey towards a more secure financial future.

We’re The Best Debt Consolidation Advisor Near You!

Looking for the best debt consolidation advisor near you? Look no further! Our team offers expert advice tailored to your unique financial situation, helping you streamline multiple debts into one manageable payment. We understand the stress of juggling various bills, and our goal is to simplify your finances. With our proven strategies, we aim to reduce your interest rates and lower your monthly payments, freeing up your budget and reducing financial strain. Our advisors are dedicated to providing personalized solutions that fit your needs and goals. Whether you’re dealing with credit card debt, medical bills, or loans, we’re here to guide you every step of the way. Trust us to help you regain control of your financial future and achieve peace of mind. Get in touch with us today to start your journey towards financial stability.

Don't Take Our Word For It. Hear What Our Customers Say!

The positive feedback from those we’ve assisted is a testament to our dedication and expertise. Here, we share a four testimonials from our satisfied clients who have experienced significant benefits from our debt consolidation services.

"This company was a lifesaver for me. I was overwhelmed with multiple credit card bills and high-interest rates. Their team guided me through a consolidation plan that simplified my payments and reduced my overall debt. I can finally breathe easy knowing I’m on track to be debt-free."

Sarah J.

Overcoming Financial Stress

"Thanks team, I’ve been able to start fresh financially. Their team provided excellent support and tailored a plan that fit my needs. The consolidation not only reduced my monthly payments but also gave me peace of mind. I highly recommend their services to anyone struggling with debt."

Emily T.

A Fresh Start

"I was hesitant about debt consolidation, but they made the process straightforward and stress-free. Their professional advice helped me understand my options and choose the best plan for my situation. Now, I’m in control of my finances and seeing a clear path to becoming debt-free."

Michael R

Gaining Control

"My experience with this company was exceptional. They provided personalized service and worked diligently to find the best solution for my financial problems. Their expertise and commitment to helping me get out of debt have been invaluable. I’m grateful for their support and the positive impact they’ve made on my life."

Lauro M.

Exceptional Service

Frequently Ask Questions

Debt consolidation can be a strategic move for managing multiple debts, but it often raises many questions. Understanding how it works and whether it’s the right choice for you is crucial. Here are ten frequently asked questions about debt consolidation, answered to help clarify this financial option.

What is debt consolidation?

Debt consolidation involves combining multiple debts into a single loan or payment plan. This can simplify your finances by reducing the number of payments you need to manage and potentially lowering your interest rate.

How does debt consolidation work?

Typically, you take out a new loan to pay off your existing debts. This new loan has a single monthly payment and often a lower interest rate. The goal is to make debt management easier and more affordable.

What types of debts can be consolidated?

What types of debts can be consolidated? Most unsecured debts, like credit card balances and personal loans, can be consolidated. Some secured debts, like auto loans or mortgages, can also be consolidated under specific conditions.

What are the benefits of debt consolidation?

The primary benefits include simplified payments, potential cost savings through lower interest rates, and the potential to improve your credit score by reducing the number of open accounts.

Are there any risks involved with debt consolidation?

Yes, there can be risks. If you don't manage the new loan responsibly or if the terms aren’t favorable, you might end up with more debt. Additionally, extending the loan term might lower your monthly payments but increase the total interest paid over time.

How do I know if debt consolidation is right for me?

Assess your financial situation, including the total amount of debt, interest rates, and your ability to make payments. Consulting a financial advisor can help you determine if consolidation is a suitable solution for your specific needs.

What are the different types of debt consolidation options?

Common options include balance transfer credit cards, personal loans, home equity loans, and debt management plans. Each has its own advantages and requirements.

Will debt consolidation affect my credit score?

Debt consolidation can impact your credit score both positively and negatively. Initially, it may lower your score due to the hard inquiry and changes in your credit report. However, timely payments on the new loan can improve your score over time.

Can I consolidate student loans?

Yes, federal student loans can be consolidated through a Direct Consolidation Loan. Private student loans can also be consolidated, but it typically requires a private lender and may have different terms.

How long does the debt consolidation process take?

The time frame varies depending on the method chosen. For example, obtaining a personal loan for consolidation might take a few weeks, while a debt management plan could take several months to set up.

If you have more questions about debt consolidation or need personalized advice, don’t hesitate to reach out. Contact us today for expert guidance tailored to your financial situation. We’re here to help you navigate your debt consolidation options and find the best path forward.