CALL US NOW: (555) 555-5555

Simple vs. Compound Interest

in Tucson AZ

Escape the Debt Trap: Consolidate and Reclaim Your Financial Peace!

Take the first step towards financial freedom →

Tucson Debt Consolidation

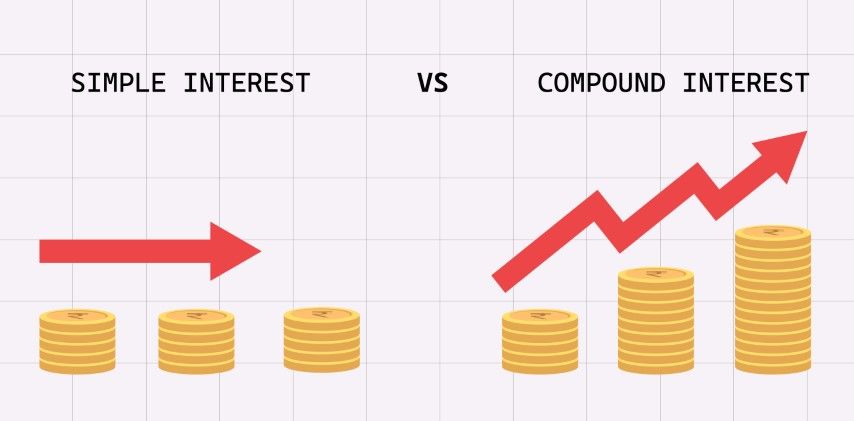

Understanding the differences between simple and compound interest is essential for effective financial planning. Each type of interest impacts your investments, savings, and loans differently. Here's a look at both types and how they can influence your financial decisions.

What is Simple Interest

Simple interest is calculated on the principal amount of a loan or investment. The formula is straightforward: Interest = Principal × Rate × Time. For example, if you invest $1,000 at an annual interest rate of 5% for 3 years, the simple interest earned would be $150. This type of interest is often used for short-term loans and investments where the interest is not expected to accumulate significantly.

What is Compound Interest

Compound interest, on the other hand, is calculated on the initial principal, which also includes all the accumulated interest from previous periods. This results in interest being earned on interest. The formula for compound interest is A = P (1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest. If you invest $1,000 at an annual interest rate of 5%, compounded annually for 3 years, you would end up with approximately $1,157.63. Compound interest can significantly increase your returns over time, especially with long-term investments.

When to Use Simple Interest

Simple interest is typically used for short-term financial products like car loans or personal loans where the loan term is relatively short. It is also used in situations where the interest earned or paid is minimal. Simple interest can be beneficial when you want to calculate straightforward costs or returns without the added complexity of compounding.

When to Use Compound Interest

Compound interest is more advantageous for long-term investments and savings accounts where the interest can grow over time. It is commonly used for retirement accounts, savings bonds, and mortgages. Compound interest can maximize returns on investments by allowing interest to be earned on previous interest, making it ideal for building wealth over an extended period.

We will get back to you as soon as possible.

Please try again later.

Factors to Consider When Deciding Between Simple and Compound Interest

When choosing between simple and compound interest, consider the length of the investment or loan term, the frequency of compounding, and the overall financial goals. For short-term goals and minimal interest accumulation, simple interest may be sufficient. However, for long-term goals and investments where the interest growth is critical, compound interest can offer greater benefits. Also, review the frequency of compounding, as more frequent compounding can lead to higher returns.

How to Align Interest Type with Personal Financial Goals

Aligning the type of interest with your financial goals involves evaluating how long you plan to invest or borrow money. For savings or investment goals that span several years, compound interest is generally the better choice due to its potential for greater returns. For short-term borrowing or investment needs, simple interest may be more appropriate. Assess your financial goals, time horizon, and the impact of interest on your finances to make the best decision.

If you’re unsure which interest type best suits your financial situation or need assistance with planning, contact us today. Our team is here to help you understand your options and make informed decisions that align with your financial goals.

Key Differences Between Simple and Compound Interest

Understanding interest is crucial when it comes to managing finances, whether you're saving money or taking out a loan. Two fundamental types of interest are simple interest and compound interest. Here’s a concise overview of their key differences:

Calculation Basis

Simple interest is calculated only on the initial principal amount. This means that the interest you earn or pay does not change throughout the term of the investment or loan. For example, if you invest $1,000 at a simple interest rate of 5% annually, you will earn $50 each year, making a total of $150 over three years.

In contrast, compound interest is calculated on the principal amount as well as on any interest that has already been added. This means that each period's interest is calculated on the new total, which includes previously accrued interest. For instance, if you invest $1,000 at a 5% annual compound interest rate, the amount of interest earned will increase over time, as interest is added to the principal and the previous interest.

Complexity of Calculation

Simple interest calculations are straightforward and easier to manage. It involves basic arithmetic and provides a clear view of how much interest will be earned or owed.

Compound interest involves more complex calculations, especially when interest is compounded multiple times per year. Understanding the effects of different compounding periods (annual, semi-annual, quarterly, monthly) can be challenging but is crucial for accurately assessing growth or repayment amounts.

Growth Over Time

With simple interest, the growth is linear. You earn or owe the same amount of interest each period. For example, if you have a $1,000 deposit with a 5% annual interest rate, you earn $50 each year.

Compound interest results in exponential growth. As interest accumulates, the amount of interest earned or paid increases with each compounding period. Using the same $1,000 deposit and 5% annual interest rate, if interest is compounded annually, you’ll earn more than $50 in subsequent years due to the interest on the interest previously earned.

Interest Accumulation

In simple interest, the interest amount remains the same for each period. This predictability is useful for straightforward calculations but might not yield the best returns in long-term investments.

Compound interest, however, allows for interest to be earned on both the principal and accumulated interest. This means that over time, your investment grows more significantly compared to simple interest, especially if the interest is compounded frequently (e.g., monthly, quarterly).

Examples and Applications

Consider a savings account with simple interest. If you deposit $5,000 at an annual interest rate of 3%, you will earn $150 each year. Over 10 years, you’ll accumulate $1,500 in interest, making a total of $6,500.

If the same $5,000 is placed in an account with 3% compound interest, the amount of interest earned will be higher due to the effect of compounding. After 10 years, the total balance will be approximately $6,720, illustrating how compound interest results in a greater accumulation of wealth over time.

Impact on Savings and Loans

For savings, compound interest is more beneficial as it allows your money to grow faster. Interest is calculated on both the initial amount and the accumulated interest, leading to more significant returns over time.

For loans, compound interest can increase the total repayment amount. If a loan compounds interest frequently, you’ll end up paying more in the long run compared to a loan with simple interest.

Effectiveness for Different Periods

Simple interest is often used for short-term loans or investments, where the time frame is limited. It’s straightforward and easy to calculate, making it suitable for temporary financial situations.

Compound interest is more advantageous for long-term investments and savings. Over time, the compounding effect becomes more pronounced, making it ideal for retirement accounts, savings bonds, and long-term loans.

In summary, the choice between simple and compound interest in Tucson, AZ depends on your financial goals and the time horizon. Simple interest offers predictable and stable returns or costs, while compound interest provides the potential for exponential growth, especially beneficial in long-term financial planning. Understanding these differences helps in choosing the right financial products and planning strategies.

Why to Carefully Consider Interest Types When Making Financial Decisions

When making financial decisions, understanding different types of interest is crucial. The choice between simple and compound interest, and the impact of interest rates, can significantly affect your financial outcomes. Here's why you should carefully consider these factors:

Simple Interest

Simple interest is calculated on the principal amount only. For example, if you invest $1,000 at a simple interest rate of 5% annually, you'll earn $50 each year, resulting in a total of $200 in interest over four years. This straightforward calculation is easy to understand but may not be as beneficial for long-term investments compared to compound interest.

Compound Interest

Compound interest is calculated on the principal amount plus any accumulated interest. This means that interest is earned on previously earned interest, leading to exponential growth. For instance, with the same $1,000 investment at a 5% annual interest rate, compounded annually, you would earn more over time than with simple interest. The effect of compounding becomes more pronounced as the investment period increases, making it a powerful tool for growing savings.

Interest Rate Variability

Interest rates can vary significantly between different financial products and institutions. A higher interest rate on a savings account or investment can lead to greater earnings, but it is essential to consider how frequently the interest is compounded. Similarly, for loans or credit, higher interest rates mean higher repayment amounts. Therefore, comparing interest rates across various options can help you make more informed financial decisions.

Fixed vs. Variable Interest Rates

Fixed interest rates remain constant over the life of a loan or investment, providing stability and predictability. This can be advantageous if you prefer consistent monthly payments or stable investment growth. On the other hand, variable interest rates can fluctuate based on market conditions. While they might start lower than fixed rates, they carry the risk of increasing over time, which could lead to higher costs or lower returns.

Long-Term Financial Impact

When evaluating financial products, consider the long-term impact of interest types. Compound interest can significantly enhance the growth of investments over time, making it ideal for retirement savings or long-term goals. Conversely, if you're taking out a loan, understanding the interest type and rate helps in budgeting and managing repayments effectively.

In summary, carefully considering interest types when making financial decisions can have a profound impact on your financial health. By understanding simple versus compound interest, comparing interest rates, and choosing between fixed and variable rates, you can make more informed choices that align with your financial goals.

LET'S CONNECT!

Our goal is to help you manage and reduce your debt more effectively. By consolidating multiple debts into a single loan, we simplify your payments and potentially lower your interest rates. Our experienced team works closely with you to understand your unique financial situation and tailor a consolidation plan that meets your needs. Whether you are dealing with credit card debt, personal loans, or other financial obligations, we are here to provide support and solutions. Contact us today to learn more about how we can assist you.